Harvey Norman AGM Blow-up – Is this a clash of Traditional Retail & Modern Retail?

Share

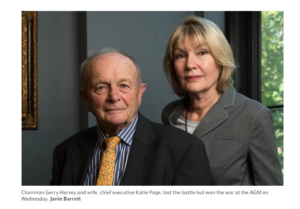

Sensational scenes, shouting matches, expletives no we are not at a rowdy football match we are at the Harvey Norman 2019 Annual General Meeting where at the end of it all Harvey Norman faced a potential board spill after shareholders handed the furniture and electronics retailer a second consecutive strike on executive pay.

Yes, Harvey Norman Holdings Ltd is a Public Company and yes it has a competent board, however, let us call out Harvey Norman for what it is – a family run business with Gerry as Chairman and Katie as CEO firmly in command and control. Katie Page was quite explicit in her interview on Friday 29th November 2019 in the Australian Financial Review “You buy-in, you buy us”.

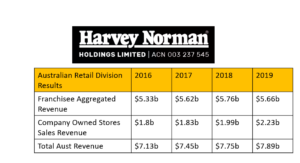

While the family dynasty in retail has been a successful formula in the past not just in Australia but overseas, for example, Nordstrom Department Stores in the USA, in the case of Harvey Norman, the business is in need of a substantial upgrade and renewal especially in its largest operating group – the Australian Retail Division where sales have been lackluster for a number of years.

The big challenge facing their Australian Retail Division is, it is stuck in a time warp based on traditional retail concepts that are not agile or flexible enough to keep up with changing consumer buying habits and younger demographics that soon will be their key customers – we shouldn’t forget Millennials next year will turn 40 and the over 40’s working population is in steady decline – 20 % decline in the next 6 years

Here is what Harvey Norman can do to unlock shareholder value by embracing Modern Retail Concepts and updating some of their long-held traditional views on retail.

1. Improve the Australian Retail Business to unlock property values.

With a property portfolio of 94 complexes here and 24 overseas generating rental revenue of $339m from Harvey Norman Franchisees and other tenants a great deal of the $2.99 billion property asset value as stated in the 2019 Annual Reports are tied up with the success of the Australian Retail Operations. A stronger retail business translates to higher property asset values.

2. E-Commerce Adoption

Whenever you go onto a Harvey Norman Group website you have to request a price for furniture and bedding range so currently, they are not offering true eCommerce. Of course, we have all heard Gerry promote his view on e-commerce as the “evil empire” and this reflects in HN strategy.

Whenever you go onto a Harvey Norman Group website you have to request a price for furniture and bedding range so currently, they are not offering true eCommerce. Of course, we have all heard Gerry promote his view on e-commerce as the “evil empire” and this reflects in HN strategy.

Well, facts speak louder than words and Williams Sonoma a US furniture & homewares retailer generates 53% of Total Sales of US$5.3 Billion off e-commerce in 2018 – boom!

This approach by Harvey Norman infuriates shareholders due to gifting sales to e-commerce players like Temple & Webster, Matt Blatt, etc. and other competitors.

Potential revenue gain for Harvey Norman should be between 10% and 15% of revenue or $1 billion in revenue gain if they embrace eCommerce.

3. Warehouse & Distribution Revitalisation:

The group operates 195 franchise complexes in Australia consisting typically of separate franchises for Computer, AV/IT, White Goods, Furniture, Bedding and often Homewares. Attached to these complexes are warehouses that service franchisees in the complex.

Anyone who has visited these on-site warehouses to pick up their purchases will notice a lot of them are poorly run and filled to the rafters with new and aged stock.

Franchising is about gaining scale efficiencies through standardizing systems and processes. Franchisee’s core competency is more in retail selling and customer experience. To unlock value, I would focus on re-engineering local warehouse and distribution with potential savings of several million dollars.

An unrealized competitive advantage of HN is these localized warehouses that would substantially cut down the cost of e-commerce sales and boost revenue for local franchisees.

Read 4 Ways To Drive Business Growth

4. Marketing Spend

With a marketing spend of $391m in 2019 a lot of which is spent on traditional marketing – sponsorship, TV, Newspaper and Catalogue, in my opinion there would be a potential saving I have estimated at $100m if HN revamped their media spend with no substantial loss of coverage.

Digital media spend has overtaken traditional media spend in the USA in total $ and Australia is similar to the US, this is where to focus. A rebalance of marketing spend is in order

By comparison currently, JB HiFi Group generates 5.6% of their total revenue from eCommerce sales via 13.7 million hits per month on their website whereas Harvey Norman generates 4.923million monthly hits to their website (Similarweb November 2019).

This represents a big fail in terms of marketing outcomes and attracting a younger audience

5. Aged Stock:

All retailers have aged stock where you can expect to recover your cost (so it does not impact stock asset valuations) however would impact profitability via lower margin if sold below recommended retail price.

Hidden in plain sight is the Franchisees that generate $5.66b in revenue and on my estimate would be holding stock of close to $1b of which a % would be aged but not obsolete. (assumption: based on HN 2019 company-owned stores gross margin of 32% and stock turns of 3.81).

All that appears in the HN Annual Accounts are rental and franchise fees received from their franchisees however there is little data provided on the underlying performance of the franchise group. Opening this data up to the market would improve transparency and confidence in the business.

6. Brand Refresh

The retail business needs a brand refresh to format, systems, layout, and marketing. Other than the new Auburn complex recently opened the other 194 complexes they operate out are looking tired and a tad old fashioned.

With the over 40 working population declining by 20% over the next 6 years like most retailers Harvey Norman will need to attract more millennials and Z generation. A brand refresh is well overdue. I have written extensively about a homewares brand that is showing the way here and globally called Few & Far, perhaps a store visit is in order.

Summary

In an exclusive interview on Friday with the Australian Financial Review Gerry Harvey floated the idea of privatizing or selling to private equity – ” I think there is a reasonable opportunity at some stage that may be private equity will come into companies like Harvey Norman trying to find a home for their money”.

At a personal level, Gerry Harvey and Katie Page have nothing to prove, they have built shareholder value over many years, the question is are they open to change by embracing tried and tested modern retail concepts to unlock shareholder value or will they persist with their current beliefs which in my view locks HN out of revenue growth and cost-cutting opportunities as detailed.

This clash between staying with the old ways or embracing change is playing out in many retailers today, Harvey Norman is but one example.

One of the smartest retailers in Australia, in my opinion, is Frank Lowy who timed it perfectly in selling out of the Westfield Group. He recognized that times had changed and past successes are not always a predictor of future success. He had nothing to prove and retired at the top.

One of the smartest retailers in Australia, in my opinion, is Frank Lowy who timed it perfectly in selling out of the Westfield Group. He recognized that times had changed and past successes are not always a predictor of future success. He had nothing to prove and retired at the top.

We look forward to seeing how the next 12 months play out at Harvey Norman and what Gerry & Katie do.

Follow us on social media