Retail Lease Modelling 2020

Share

Retail Rents will have to fall by 30% to 50% for retailers to survive for the next 12 months.

We have been busy over the last 4 weeks reviewing retailers store forecasts and modeling various lease scenarios for the next 12 months to ensure retailers can survive once shopping malls and stores reopen for business.

For most discretionary retailers paying between 20% and 27% of their annual store revenue on rent and outgoings, nearly all will go broke if they cannot renegotiate their leases for the next 12 months or longer depending on when mall and precinct customer traffic returns to 2019 levels.

Retail rents will have to fall by 30% to 50% for retailers to survive if our forecasts are correct.

For forecasting purposes, we applied the following benchmarked based on our own research and also referenced research by Bain Consulting Group & McKinsey’s.

Last week in my article “Retail Landlord Covid-19 Negotiations: The Only Sensible Deal During Lockdown”, I detailed out why charging rent based on a % of turnover was the only fair way to calculate rent going forward. This article provides data points to substantiate our recommendations.

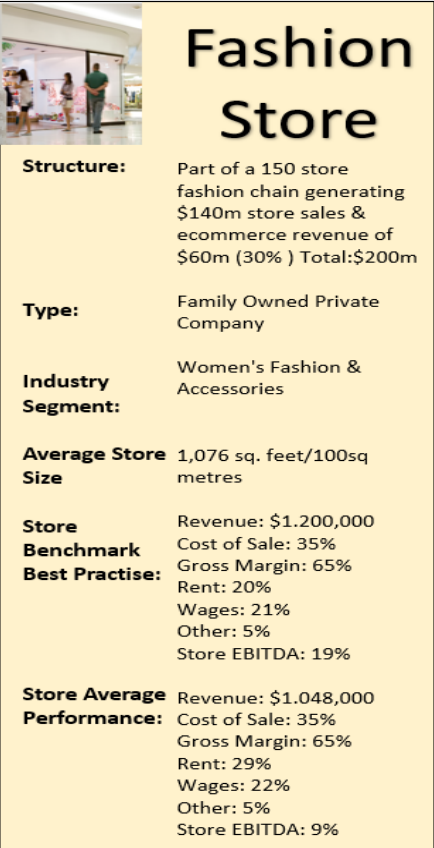

Case Study: Retail Fashion Group

We calculated what is the impact of fixed rent on retailers not only during the Covid-19 lockdown but also for the next 12 months after stores reopen based on recession conditions and social distancing.

We calculated what is the impact of fixed rent on retailers not only during the Covid-19 lockdown but also for the next 12 months after stores reopen based on recession conditions and social distancing.

This “fictitious” fashion group is based on our collective experience in financial modeling for many discretionary retailers over the last 18 years, research & analysis, and discussions with retailers on their current experience with Covid-19.

The results below of our modeling for bricks & mortar stores from July 2020 to June 2021 is based on our assumption that the majority of malls and stores will have to reopen by July 2020 (otherwise the alternative is mass retailer bankruptcies and store closures).

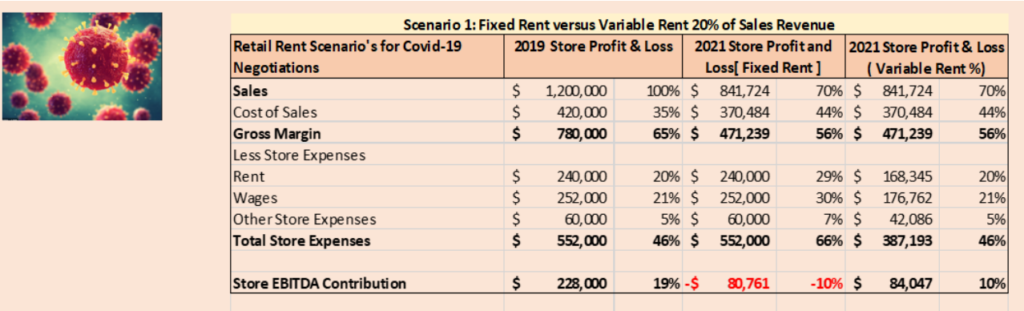

Scenario 1 Projected Results Top Performing Stores:

Our Scenario 1 is based on our Revised Sales and Margin forecasts above being applied to top-performing stores (top 20%) paying their current fixed rent. The results are:

- Sales for the 12 months to June 2021 will decline 30% compared to 2019 Sales

- Margin will decline by 9% from 65% to 56%

- Rent will increase from 20% to 29% of sales

- Wages will increase from 21% to 30% of sales

- Store EBITDA will go from +19% to a loss of 10%

By the retailer negotiating a variable % rent based on 2019 rent percentage of 20%, the stores would be able to go from a 10% loss to a 10% profit and allow the retailer to cover some or all Head Office costs.

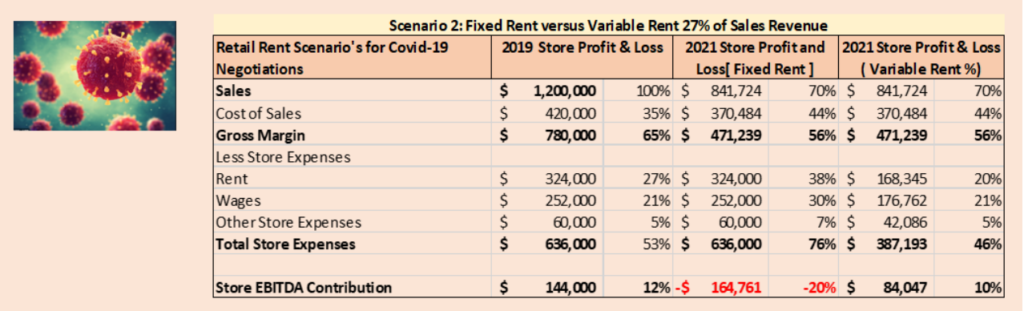

Scenario 2 Projected Results Average Store:

Taking the average store paying 27% of sales in rent we found that losses applying current fixed rent exploded to 19%.

Summary:

Based on our forecasts for 2020/2021 most retailers will have to negotiate a rent reduction of between 30% and 50% of current rents to survive.

In addition, up to 50% of current stores will be unviable moving forward and this will force retailers to accelerate the transformation of their business and the culling of unprofitable stores. When we modelled our forecast on a 140-store group all the scenarios were disastrous requiring hard decisions.

For Landlords insisting on their legal rights and Retailers refusing to pay rent, adversarial positioning will not help either party. My recommendation – starts with realistic financial modelling of retailer’s store performance across their store fleet shared with Landlords. This is a sound and realistic basis for coming to an agreement on a % sales rental based on store traffic recovery. If the economy and traffic recover more quickly than our forecasts, rents return to normal and landlords are compensated accordingly.

Is your Financial & Analytics Team Up to Scratch?

How has your finance team and supporting operations, marketing, research, and analytics teams performed on

- Sales & Margin Forecasts

- 2020 and 2021 Store Profit & Loss Forecasts

- Cash Flows based on your assumptions

- Rental Negotiations – have they worked out breakeven and Store Contribution required to survive as a basis of negotiating with landlords

Analytics is one of the key capabilities of retailers moving forward (ask Google, Amazon, and Alibaba).

Has your team performed? compare their results to our insights and analysis and judge for yourself. Your survival will depend on their capability and ability to come up with creative commercial solutions.

Follow us on social media