What do you do when your Retail Leaders Fail?

Share

What do you do when your Retail Leaders Fail? Often Nothing or very little according to our research.

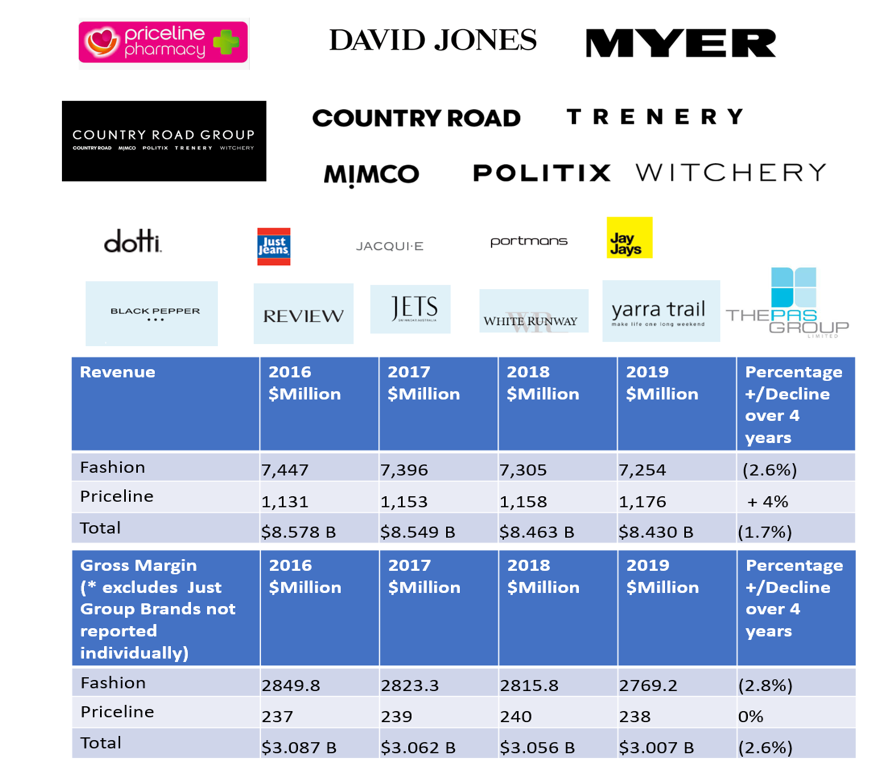

We analysed the Audited Financial Statements from 2016 to 2019 for 4 of our largest Fashion Public Companies and one Retail Pharmacy Group to get an idea on how our traditional retailers are going in transitioning to a digital economy. These 4 Fashion Brands represent 23.4% of the total fashion industry and are a fair representation of the Australian Fashion Industry as a whole.

The results over 4 years are as follows

- Sales declined by 2.5% over 4 years an effective decline in sales of 9.3% after inflation

- Gross margin declined over 4 years 3% and an effective decline in margin of 9.78%

- Inflation was 6.78% over the 4-year period

Of course, this is the tip of the iceberg with many fashion brands privately owned and it is our estimate that over 50% will be in a similar predicament of negative sales growth (after inflation) and declining margins. Many retailers will follow Jeanswest, Bardot, Colette and Harris Scarfe out the door if they don’t restructure and consider new management.

It goes without saying that for every failure there are many succeeding, for example, Market Places ( Amazon, The Iconic), Direct to Consumer (Showpo, Arnhem Clothing, Revolve) Global Fast Fashion, Rental (Glamcorner.au) and a some Australian Retailers like Cotton On, Tony Bianco, Lovisa, Peter Alexander & Smiggles that understand changing consumer behaviour and demographics.

It goes without saying that for every failure there are many succeeding, for example, Market Places ( Amazon, The Iconic), Direct to Consumer (Showpo, Arnhem Clothing, Revolve) Global Fast Fashion, Rental (Glamcorner.au) and a some Australian Retailers like Cotton On, Tony Bianco, Lovisa, Peter Alexander & Smiggles that understand changing consumer behaviour and demographics.

Retail leaders are under constant pressure these days and you need to be superman or super women to survive and prosper in the digital age.

Most of the current management and boards are still following traditional structures and job roles and are ill-equipped to handle the massive changes taking place. With 4 years of declining sales & margin, you would think there would be a sense of urgency to change however we have found the majority of retailers are either sticking with the incumbent teams despite the results or replacing one or two senior roles often with another traditional retail executive.

What leaders need to do to change the dynamics in their business

With constant change occurring there is a new set of rules that Boards and senior management need to deploy in recruiting senior management.

1. Appoint Superman or Superwoman! No such person then I suggest the following steps

2. Retail Strategy:

Develop a comprehensive retail strategy for the next 5 years that accounts for your current customers and the impact of changing demographics on your base, how differentiated are you and a realistic assessment of the last 4 years of results to identify savings to be made and potential to grow sales & profit. Most retailers typically focus on tactical planning & incremental improvement which is a recipe for continual decline.

Your Strategy needs to be achievable and realistic, facilitated externally with contribution from outside specialists and internal teams including the new executive if available.

3. Present the Strategy to the New Retail Executive

The comprehensive strategy should take a maximum of 6 weeks to develop and after being reviewed by the new executive, presented to the shareholders’ board for sign-off before being presented to the rest of the management team.

Gone are the days when a Retail Executive has 6 months to settle into a role and understand a retailer then come up with a plan.

The management team are then assessed quarterly on implementation of the plan and the results achieved. Management by outcomes.

4. New Retail Executive Job Role

New retail is driven via Chief Marketing Office driving Consumer Insights> Category Management > Innovation & Analytics> Customer Experience. Most of the Fashion Executive class do not have these skills so either the role should be split or you could copy Super Retail Group appointment of Anthony Heraghty who has both skill sets.

Examples of companies that have failed over 4 years to improve results and demonstrate what they should do to arrest the decline

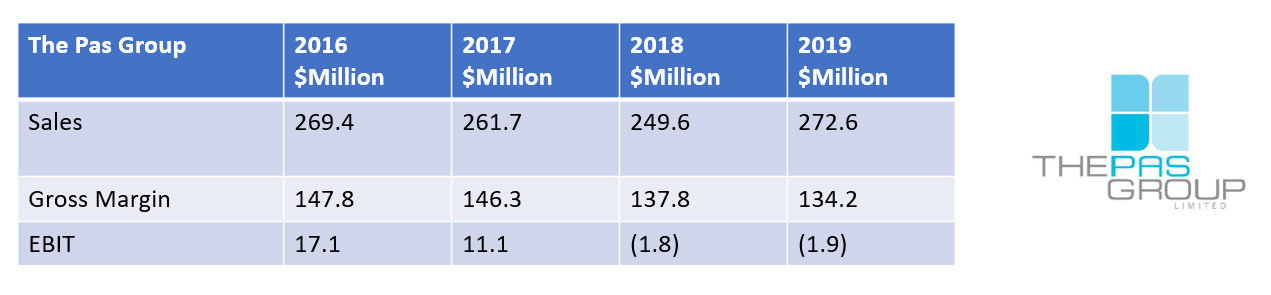

The Pas Group Ltd

With 4 years of negative results and basically the same management team in place, their strategy of diversification does not seem to be working with some strong brands in the portfolio and some weak ones. In addition, in their retail division their sales per square metre for stores is well below benchmarks for growing and profitable retailers.

With 4 years of negative results and basically the same management team in place, their strategy of diversification does not seem to be working with some strong brands in the portfolio and some weak ones. In addition, in their retail division their sales per square metre for stores is well below benchmarks for growing and profitable retailers.

Here are some suggestions:

- Restructure the current management team – the results don’t justify them staying

- The wholesale division appears to have excessive wages to sales ratio, there could be several million of potential savings here

- Focus on the brands that have upside – Review, Jets, profitable wholesale lines

- Blackpepper is on the wrong side of demographic changes and should be either sold or downsized.

- Differentiation rather than diversification should be the focus

Launa Inman an experienced retailer has been appointed a non-executive director and chairperson from the 20th February 2020 so I will be interested to see whether this appointment will lead to a changing of the guard, new strategy and transformation, time is running out.

Harvey Norman Ltd

In a recent article “Maybe it is time for Harvey Norman (HN) to Sell to Private Equity” we detailed how the traditional approach by Gerry Harvey the Chairperson and Katie Paige the CEO were frustrating shareholders and while the company was profitable maybe it was time to sell to private equity to unlock further shareholder value.

We identified the Australian Retail Business, Ecommerce, Marketing Spend, Warehousing Revitalisation and Aged Stock as areas to improve profitability. https://www.linkedin.com/pulse/maybe-time-harvey-normanhn-sell-private-equity-bill-rooney/

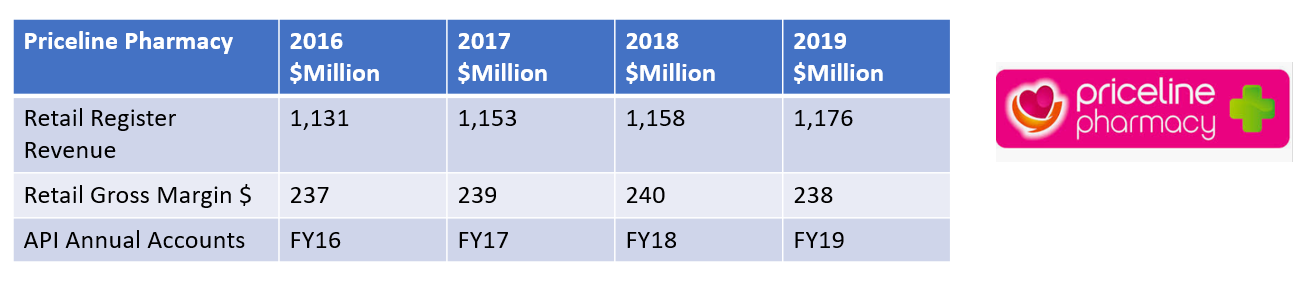

Priceline – A division of Australian Pharmaceutical Industries Limited (API)

Mr Andrew Vidler was recently appointed as General Manager of Priceline and prior to this was at EBOS Group Limited.

Mr Andrew Vidler was recently appointed as General Manager of Priceline and prior to this was at EBOS Group Limited.

Priceline is a business that has not had a major brand refresh in many years and in our opinion has lost its competitive advantage around beauty. Priceline is dedicated to helping women look good, live well and feel great.

Chemist Warehouse has copied the Priceline Store in Store Beauty Bars Concept and with much larger buying power, they have used price & promotions to increase market share against the likes of Priceline, other chains and independent pharmacies. Chemist Warehouse is the market leader and according to market research company IBISWorld holds

23 percent of the $19.5 billion Australian pharmacy market giving it a $4billion+ revenue base.

Andrew will need to refresh the brand, the product offering & store format to create a new point of difference an almost impossible task due to the cost involved with over 488 Priceline and Priceline Pharmacy branded stores throughout Australia.

Summary

There is no doubt that the Australian Retail Industry is going through tough times, what is also apparent is that quite a few of our traditional retailers are failing to adapt quickly or slowly (after all 4 years is a long time) to the changing times and therefore are suffering declining sales and margin that will inevitably will lead to their downfall.

The key is to develop a “new retail strategy” that can transform the business.

The result of the strategy is either a way forward or in the case of one of our clients they determined to wind down the business, pay off the debt and go on holidays. Either is preferable to going into administration which destroys consumer confidence, leads to increased unemployment and unpaid bills to suppliers.

Follow us on social media