Revised Retail Sales & Margin Forecast 2020 – 2021

Share

Revised Retail Sales & Margin Forecast for 2020-2021 for Recession Times.

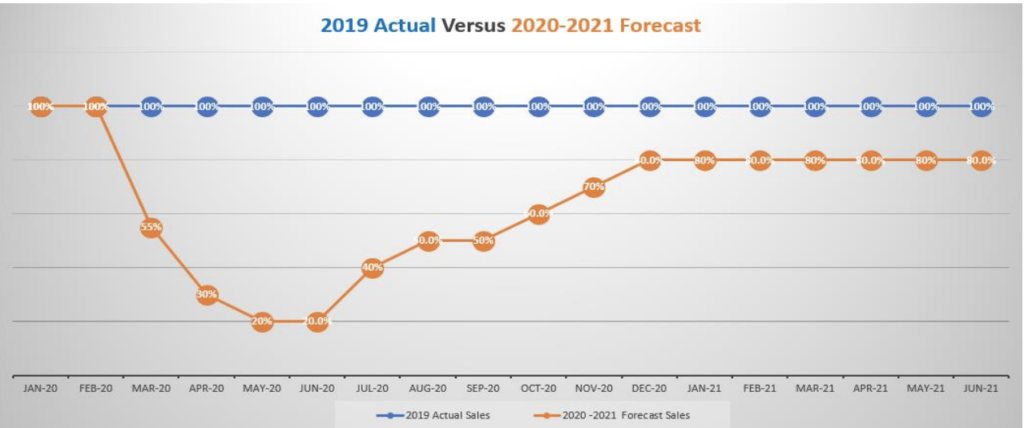

We have revised our Retail Sales & Margin Forecasts down since we released our initial Forecast on 17th March 2020. This takes into account the ensuing turmoil in global markets, lockdowns that have closed many shopping malls and stores for extended periods and the fact retail and consumer markets are facing an extended recession, reduced spending especially discretionary spending and higher unemployment.

Key Downward Trends and Implications.

Based on our assumption that the majority of malls and stores will have to reopen by July 2020 to survive we have forecast for the period from July 2020 to June 2021 the following impact on discretionary retail spend

- Sales: 30% Reduction in Sales over 12 months

- Gross Margin Reduction of 9% over 12 months mainly due to this season excess stock having to be dumped on the market at slightly above cost to clear from June to September.

- As a result of lower sales and margin rents will have to reduce by 30% to 50% for retail stores to maintain some profitability and compensate for reduced shopping mall and store traffic

- Up to 50% of stores that in 2019 were marginally profitable will have to shutter permanently. In Hong Kong, a city with a population of 7.5million the Hong Kong Retail Management Association study has estimated in 2020, 20,400 stores will shutter permanently out of 67,600 total stores a decline of 25% -30%.

- Head Office costs will have to be drastically pruned by 25% or more to compensate for lower store contribution

- Accelerated restructure focused on reinvesting in eCommerce, data analytics, technology, marketing, and customer experience

These trends have been based on applying our forecasts to customer data for UK, US, EEC, Singapore, Australian and New Zealand style retailers and market. For China, India, Asia and emerging markets where margins, rents and wages can vary from more mature markets forecasts would need to be calibrated.

How Did We Come Up with Our Forecasts?

Our forecast is based on our collective experience in financial modelling for many discretionary retailers over the last 18 years, research & analysis of publicly listed retailers, and discussions with retailers on their current experience with Covid-19.

To some retailers our forecasts seem pessimistic to which my reply is that we are going into a global recession the likes of which no one has experienced before, therefore I recommend caution as opposed to optimism.

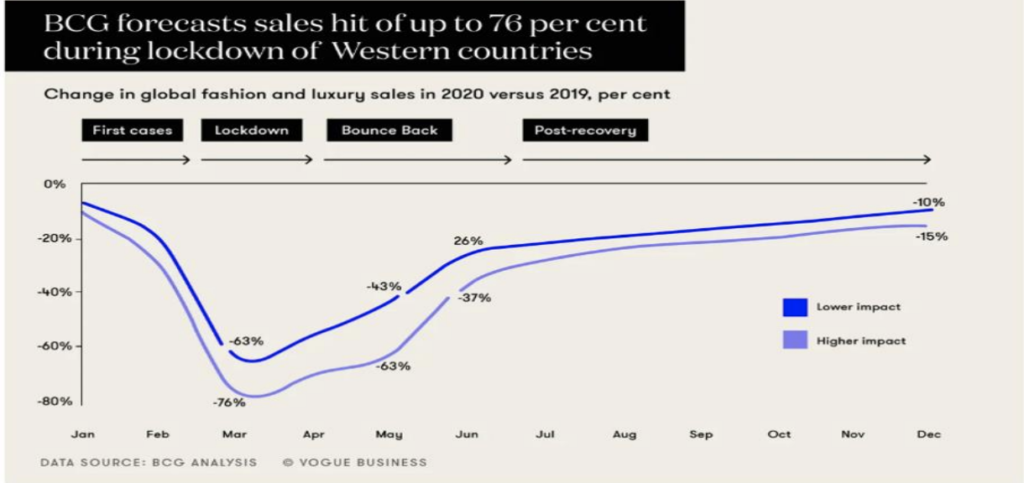

As an additional reference point, Boston Consulting Group in conjunction with Vogue Business has estimated sales in the luxury retail sector will decline by 29.2% in 2020, not dissimilar to our projections.

Summary

Consumer confidence already at rock bottom levels due to Covid-19 impact on unemployment and economic activity will suppress retail spending especially discretionary spending for at least 18 months.

Share markets and financial institutions in times of uncertainty reserve cash and suppress investment.

While share markets can bounce back quickly, investment, economic activity, under-employment and consumer confidence take much longer to bounce back. While stores may reopen, we may find consumer traffic into shopping malls and physical stores take much longer to recover thus prolonging the downturn by many months or years.

The question is how long can retailers survive.

Follow us on social media